NetZero Trade

Overview

NetZero (aka 60-40-20) is an At The Money Broken Wing Butterfly trade on SPX that Andrew Falde has devised. This trade has been explained in great detail by Mark Mosley in the Raleigh Durham Open Systematic Options Trading Strategies recording.

The options structure utilized in this trade involves a delta-neutral, positive theta, and negative vega income structure. The Broken Wing Butterfly's legs are strategically placed at deltas 60, 40, and 20 on the put side.

Trade Rules

The original trade rules are described as:

- Enter trade 60-80 days to expiration

- Select strikes having the deltas closest to 60, 40, and 20 deltas

- Exit trades when

- Middle leg’s delta changes by 30%

- Upper leg’s delta changes by 30%

- 30 days to expiration is reached

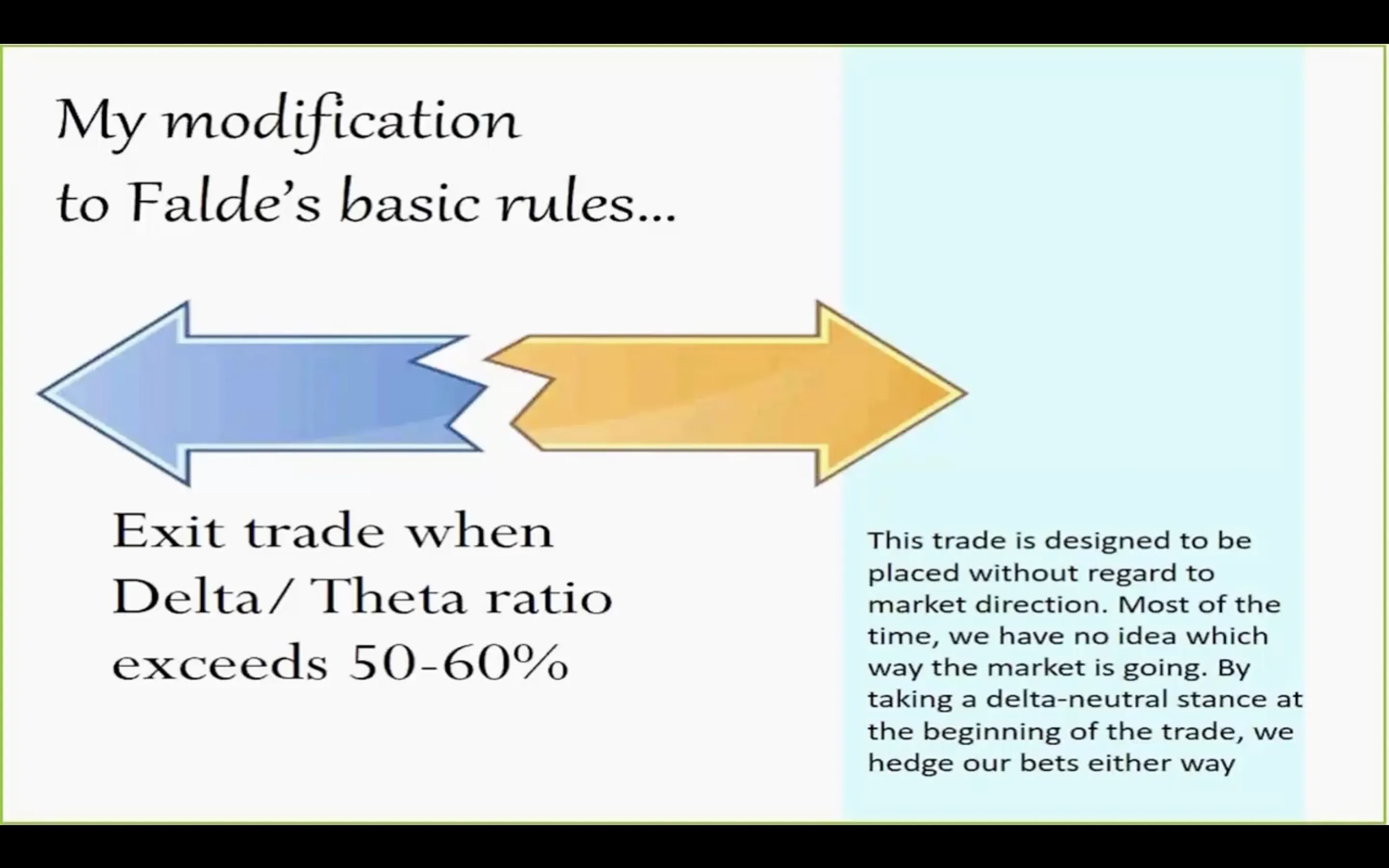

Mark Mosley has incorporated an additional exit rule into the trading strategy inspired by the methods of John Locke, whereby an early exit is taken when the delta to theta ratio (delta divided by theta) reaches a threshold of 60%.

We will validate the two variants by simulating their historical performance using MesoSim. In all simulation runs, we will use Multiple Positions in Flight to avoid relying on one execution path.

Simulating the original trade

As the structure definition is trivial, we will only spend time detailing the trade's exit rules.

To enable exit criteria based on delta comparison of the Upper Long and Middle Short Leg with their initial states, we will be recording the delta values of each leg at initiation and storing them in the designated variables:

"Entry": {

...,

"VarDefines": {

"initial_leg_shorts_delta": "leg_shorts_delta",

"initial_leg_upper_long_delta": "leg_upper_long_delta"

},

}

Then using the Exit.Conditions to describe the three criteria:

"Exit": {

...,

"MaxDaysInTrade": 999,

"ProfitTarget": null,

"StopLoss": null,

"Conditions": [

"(leg_shorts_delta - initial_leg_shorts_delta)/initial_leg_shorts_delta > 0.3",

"(leg_upper_long_delta - initial_leg_upper_long_delta)/initial_leg_upper_long_delta > 0.3",

"leg_shorts_dte <= 30"

]

}

Please note that we have set the MaxDaysInTrade parameter to an exceptionally large value to render it ineffective. This configuration is aimed at adhering to the original rules of the trading strategy, which mandate an exit from the trade when the legs approach 30 days until expiration. To implement the time based exit rule, we have chosen the leg_shorts_dte variable for the check, although the other two legs' respective variables (leg_upper_long_dte and leg_lower_long_dte) would be equally viable options.

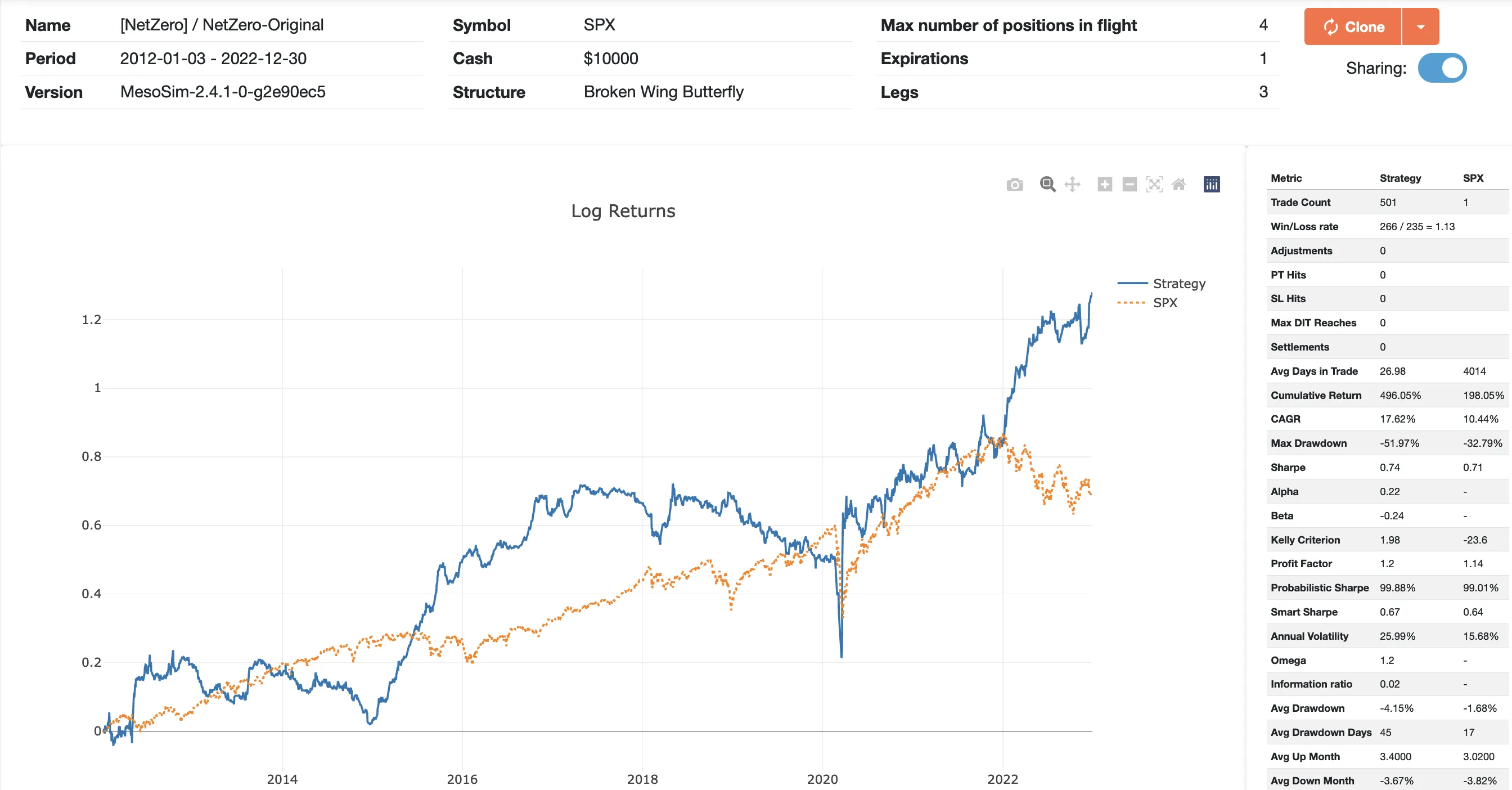

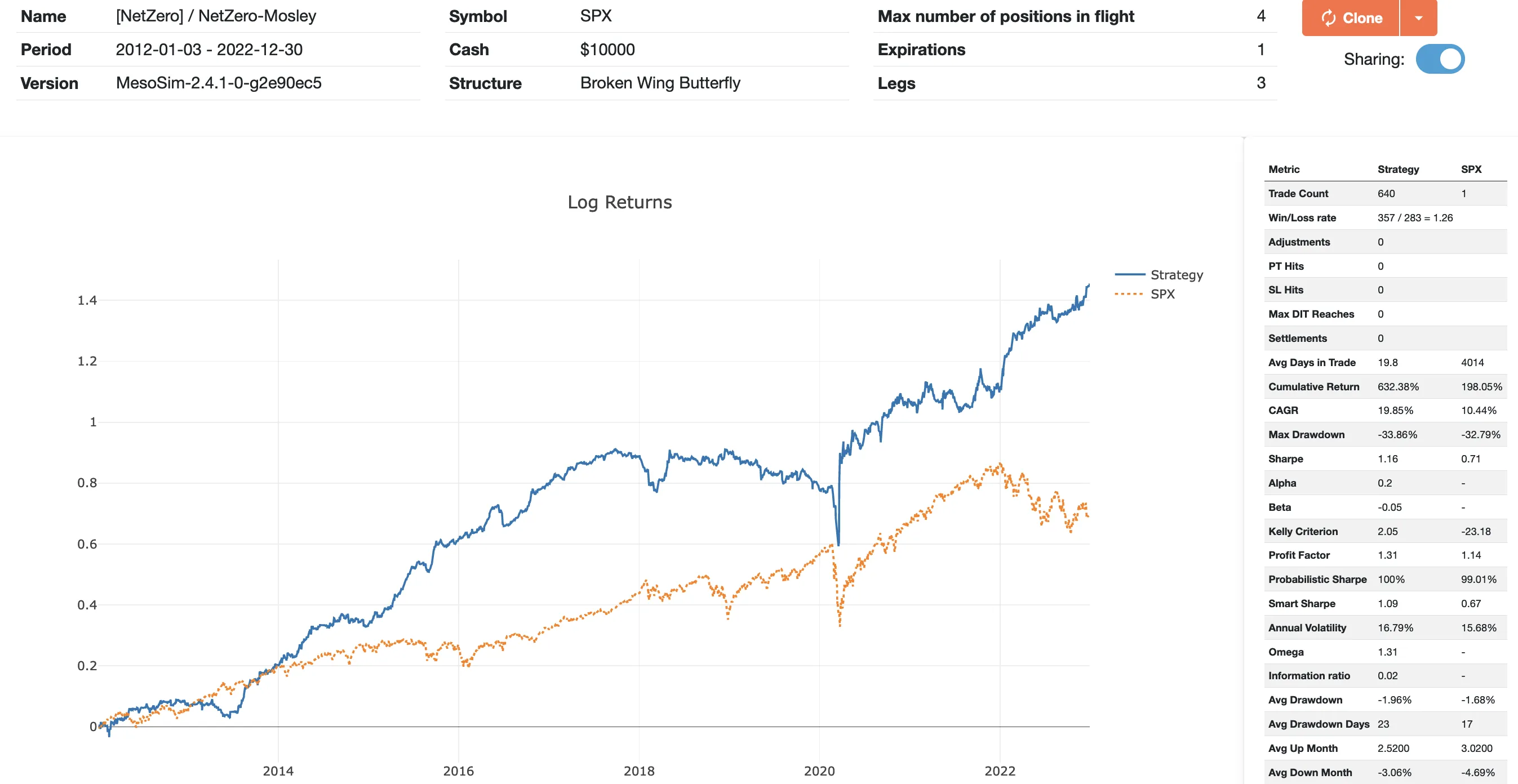

Backtest results

The full run with further statistics (full tearsheet) is available in the following link: https://mesosim.io/backtests/148c6282-e485-4807-8418-385c96815bb2

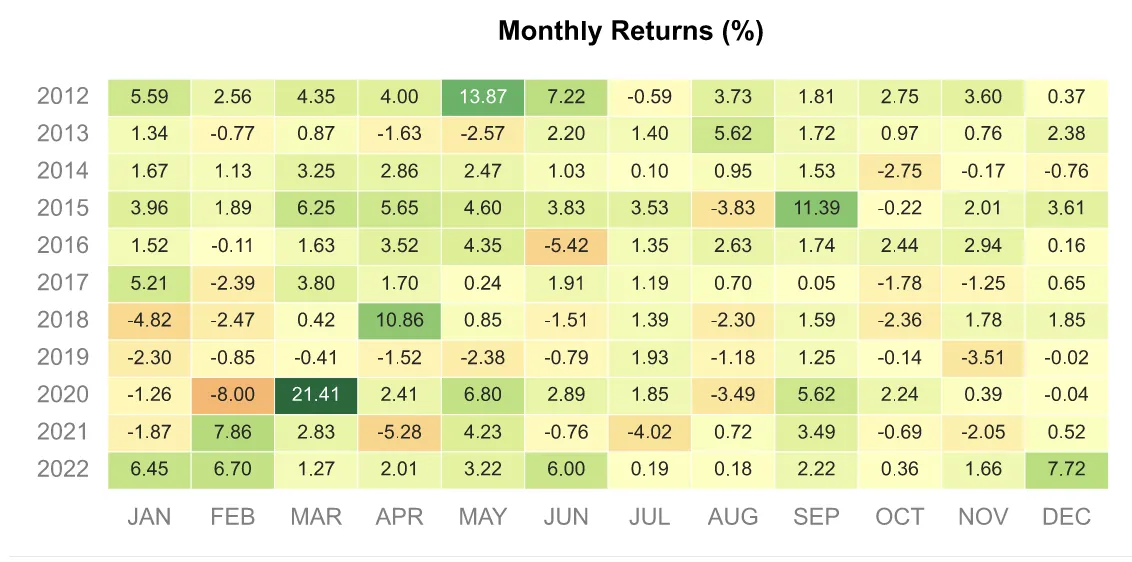

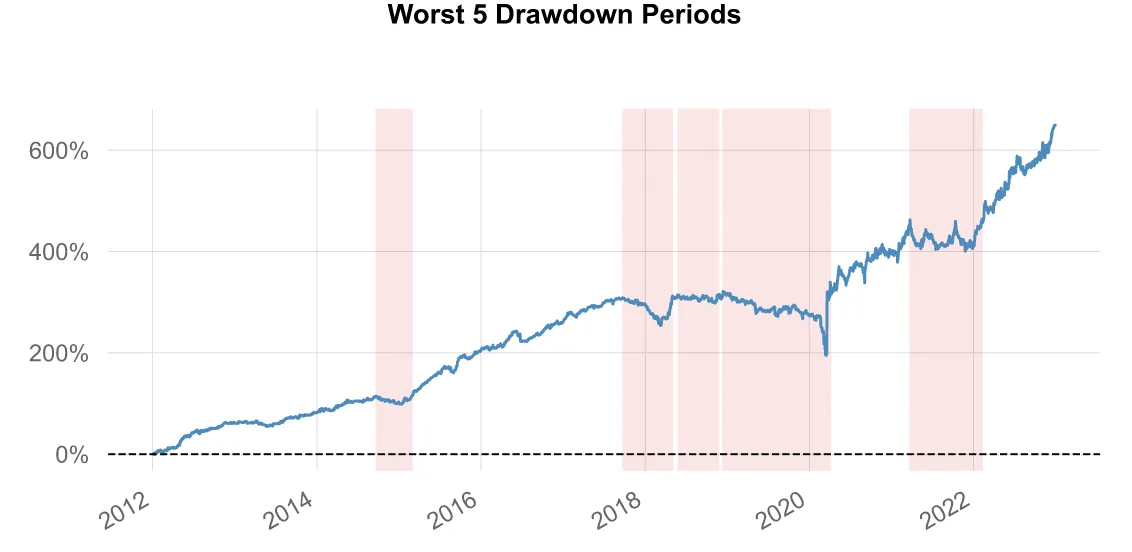

Upon reviewing the Log Return graph, we can observe that the trading strategy exhibits strong performance characteristics in markets that trade sideways, which is reflected by its outstanding performance during the periods of 2015 and 2022.

The trading strategy encounters its most challenging period during the interval between two black swan events, namely the Volmageddon in February 2018 and the Covid Crash in 2020.

Simulating Mark Mosley’s variant

During the presentation, Mark Mosley introduced an additional exit rule that employs the delta-to-theta ratio as a benchmark for exiting trades early. We suspect that this additional trading rule comes from John Locke’s methodology on trading Broken Wing Butterflies.

Additional trading rule

To integrate the additional trading rule, we have made the following modifications to the strategy definition:

- Entry.AbortCondition guarantees that we only establish positions that conform to the delta to theta ratio requirement

- Exit.Conditions are responsible for exiting the trade when the ratio becomes unfavorable

The respective rule in the Strategy Definition:

"pos_theta ~= 0 and abs(pos_delta / pos_theta) > 0.6"

The ScriptEngine in MesoSim (which utilizes Lua programming language), employs the non-equality operator, denoted by ~=. Initially, we leverage this operator to verify that the pos_theta variable is non-zero, which is necessary to circumvent any division by zero issues during the computation of the delta-to-theta ratio.

Backtest Results

Backtest Run’s URL: https://mesosim.io/backtests/3c9e63c6-d946-4d65-b736-b7d0dba4dd4f

It is apparent that the performance of the strategy is greatly improved:

- Sharpe increased from 0.74 to 1.16

- CAGR reaches 19.85%

- Max Drawdown is reduced from 50% to 33%

Our variant

This time, instead of conducting a comprehensive study on IV Rank, Underlying State, or Theta, as we did for the Boxcar trade, we will make two changes to the strategy to improve its performance.

Days in trade vs. Date till Expiry

The original rules for this trade specify the time-based exit using the "Date until Expiry" method, whereas we prefer to set the time barrier based on Days In Trade. We believe that Days In Trade is more predictable in terms of expected performance than the Date until Expiry, which can vary trade by trade. To make this change, we can set the MaxDaysInTrade variable to 30.

Truly Net Zero

According to the original trade rules, legs should be chosen closest to Delta 60, 40, and 20. However, this approach may not always result in delta=0 at the initiation, which adds slight directionality to the trade. To address this issue, we will dynamically select the Lower Long leg such that the overall structure ends up at 0 delta. To accomplish this modification, we will set the target delta for the leg to pos_delta:

{

"Name": "lower_long",

"Qty": "1",

"ExpirationName": "exp1",

"StrikeSelector": {

"Delta": "pos_delta",

},

"OptionType": "Put"

}

For further information on how delta hedging is performed, please refer to the documentation.

Furthermore, we will incorporate an extra exit criterion that will terminate the trade if it becomes overly directional during its lifecycle. Our selected thresholds to exit the position are Delta -10 and 10:

"abs(pos_delta) > 10"

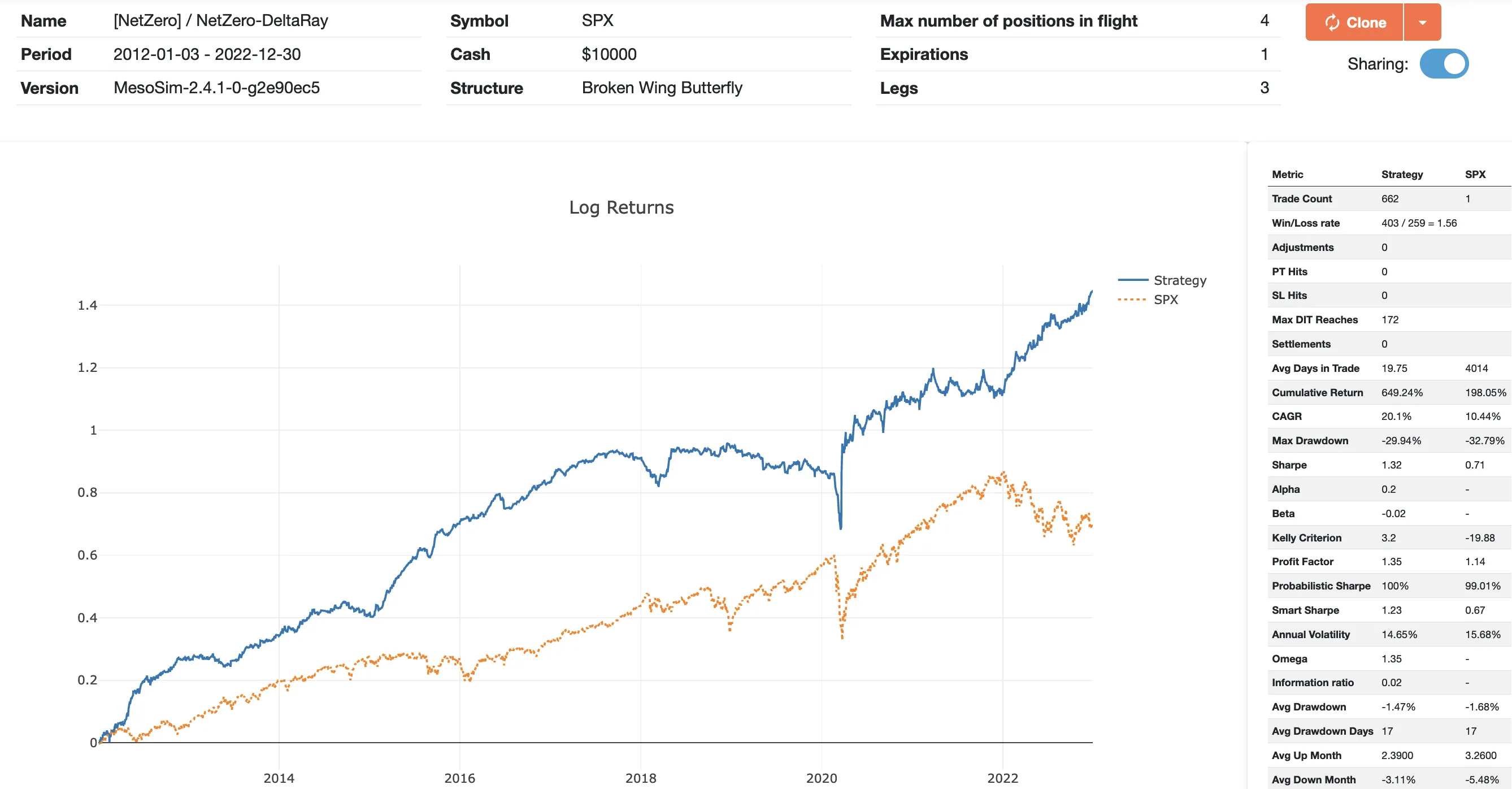

Backtest Results

Backtest Run's URL: https://mesosim.io/backtests/0fed4a1f-3b66-4adb-aa36-0a49b59936f0

Setting the initial delta of the structure to 0 and maintaining it at around that level resulted in noticeable improvements in Sharpe ratio, CAGR, and Max Drawdown compared to both variants:

- Sharpe: 1.32

- CAGR: 20.1%

- Max Drawdown: -29.94%

Although the trade experienced difficulties in the post-volmageddon period, we consider it a promising subject for further research as it demonstrated remarkable performance in sideways markets.

Future work

Hedging

Although the recovery rate is quick, a Max Drawdown of -29.94% is still a significant loss of investment. As this drawdown happened during a black swan event (Covid crash), it is recommended to include a hedge while trading this strategy. Such a hedge can be as straightforward as buying long puts (teenies), implementing a Black Swan Hedge according to Ron Bertino's PMTT course, incorporating Brent Pedersen's findings on hedging power, or using David Sun's Bomb Shelter or Vibranium Shield.

Volmageddon - COVID period

We attempted to pinpoint the root cause of the structure's difficult period by examining its Risk Profile and analyzing various metrics, including:

- Position Theta, Gamma, and Vega throughout the trade

- Relative (to the underlying) and Absolute Prices of the structure and the individual legs

Unfortunately none of these metrics yielded significant insights into the reasons for the trade's underperformance during the mentioned period. Since we acknowledge that there is no silver bullet solution to trading, we accept the structure in its current state.

If you have any suggestions for improving the trade, please feel free to leave a comment. We welcome and value your input.

Conclusion

We have performed a simulation of a public SPX trade using MesoSim, which has shown exceptional performance in 2022. Therefore, we consider it a promising candidate for future research. We believe this trade would complement the Boxcar-NG trade well, resulting in a well-rounded portfolio.

This article was originally written for MesoSim v2. The examples and terminology have been updated to match the MesoSim v3 Strategy Definition format. For details, see the MesoSim v3.0 release announcement and the v2→v3 migration guide. The performance metrics, described behavior, and referenced run results reflect the original v2 behavior. If you rerun the referenced strategies on MesoSim v3, results may differ slightly due to behavioral changes in the simulator.