Strategies that survived VolZilla

The Event

On August 5, 2024, Japanese stocks suffered their biggest daily loss since 1987. The Nikkei 225 closed down by over 12%. Shortly afterward, the Bank of Japan raised interest rates, causing the yen to surge higher. The increased interest rates and stronger yen forced market participants to unwind their yen carry trades.

What’s the FX carry trade? An FX carry trade is a financial strategy where an investor borrows money in a currency with a low interest rate, such as the Japanese yen or the Swiss franc, and then uses those funds to invest in assets denominated in a currency with a higher interest rate, such as the U.S. dollar. The goal is to profit from the interest rate differential between the two currencies. This strategy can be lucrative in stable markets but carries risk if exchange rates fluctuate unexpectedly.

Parallel to the above, the U.S. stock market (S&P 500) gapped down on Friday, August 2nd, and continued to decline throughout the day related to weak economic data. The VIX, a key measure of market volatility, moved into backwardation (IVTS > 1) during the trading session.

On Monday, August 5th, the market fell an additional 3%, while the VIX skyrocketed, reaching a level of 65.

For the S&P 500, this market movement was considered a normal correction: sub 10% drop from ATH. However, it caused significant trouble for options sellers: Many suffered losses ranging from 15% to 50%, while some completely wiped out their accounts and were unable to recover.

In this article, we provide an overview of how the strategies from our Strategy Library performed during these events.

Strategies & trade setup

While we have over 20 built-in templates in MesoSim, we will focus here on a selection that we consider immediately executable and truly out-of-sample.

Expectation setting:

Please note that the majority of these strategies come with little to no hedging.We always emphasize the importance of hedging in the respective blog posts.Therefore, it should not be surprising if some of these strategies result in large drawdowns.

To ensure a fair comparison, we will use the same time period for all the strategies and maintain the cash allocation as defined during strategy development. Since some of the trades leverage MesoSim’s Multiple Positions in Flight feature, they require time to build a full allocation.

With that in mind we set our backtest period to 2024. 01. 01. - 2024. 09. 06. ,that is truly Out of Sample for every strategy in our list.

Test Results

| Backtest | CAGR | Max DD | Sharpe | Type |

|---|---|---|---|---|

| SuperBull-Relaxed | 110.71% | -24.3% | 1.87 | Directional |

| VolatilityHedged-ThetaEngine | 213% | -24.12% | 1.51 | VRP |

| Boxcar | 22.83% | -38.88% | 0.64 | VRP |

| ShortPut-45DTE | 22.83% | -38.88% | 0.64 | VRP |

| ShortPut-45DTE + TrailingStop | -24.29% | -58.96% | -0.01 | VRP |

| ThetaEngine | -12.54% | -19.44% | -0.53 | VRP |

| WeekendEffect | -63.97% | -64.23% | -0.59 | VRP |

| 0DTE-IronCondor | -11.63% | -11.83% | -0.78 | VRP |

| NetZero | -36.78% | -178.19% | -1.22 | VRP |

| Boxcar-NG | -70.96% | -59.58% | -1.5 | VRP |

| Box Spread | 4.79% | -2.19% | 0.65 | Interest Rate |

SuperBull-Relaxed

This trade is a variant of John Locke’s SuperBull strategy by Rafael Munhoz, which we published on July 8, 2023.

It is a bullish, At-The-Money Call Debit Spread that has performed well in 2024. The VolZilla event resulted in the strategy's second-largest drawdown this year. Its PnL is more influenced by Delta than Vega; therefore, VolZilla had little impact on its overall performance.

Associated backtest: https://mesosim.io/backtests/e0b9baeb-673a-4cf6-899c-0de5e5287bcd

Thanks to Rafael for developing and contributing this trade to the library!

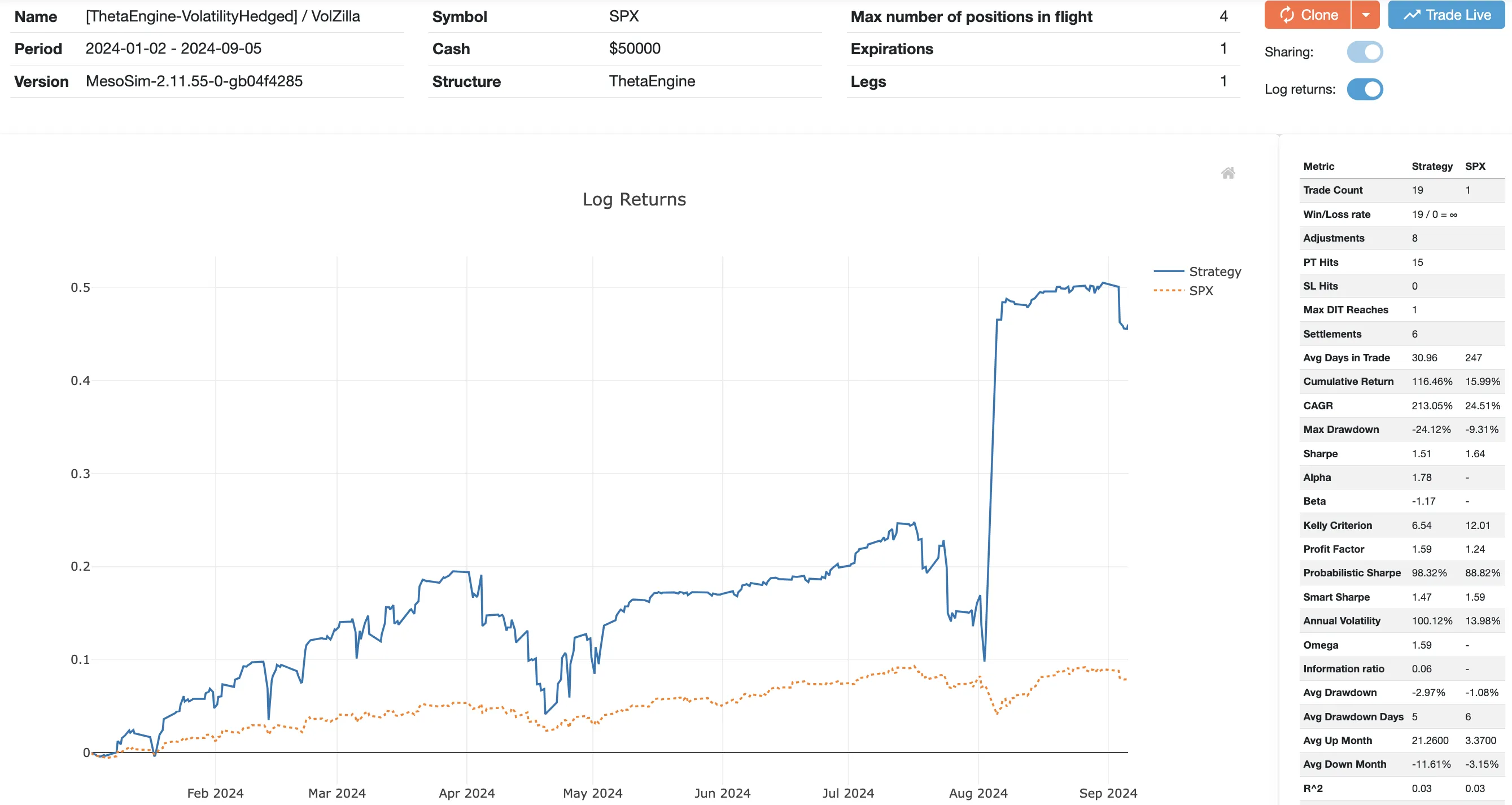

Volatility Hedged ThetaEngine

This trade is a variant of David Sun’s Theta Engine strategy by Claudio Valerio, which we published on June 29, 2023.

It is a 90 DTE Short Put that converts into a Put Ratio Backspread in the case of elevated implied volatility (IV). The put ratio backspread was active during the VolZilla event, resulting in a substantial profit during the market crash.

The hedging strategy worked exceptionally well in this scenario.

Associated backtest: https://mesosim.io/backtests/dd8edcb2-9747-4783-bb0a-d629c25874a9

Thanks to Claudio for developing and sharing this trade with us!

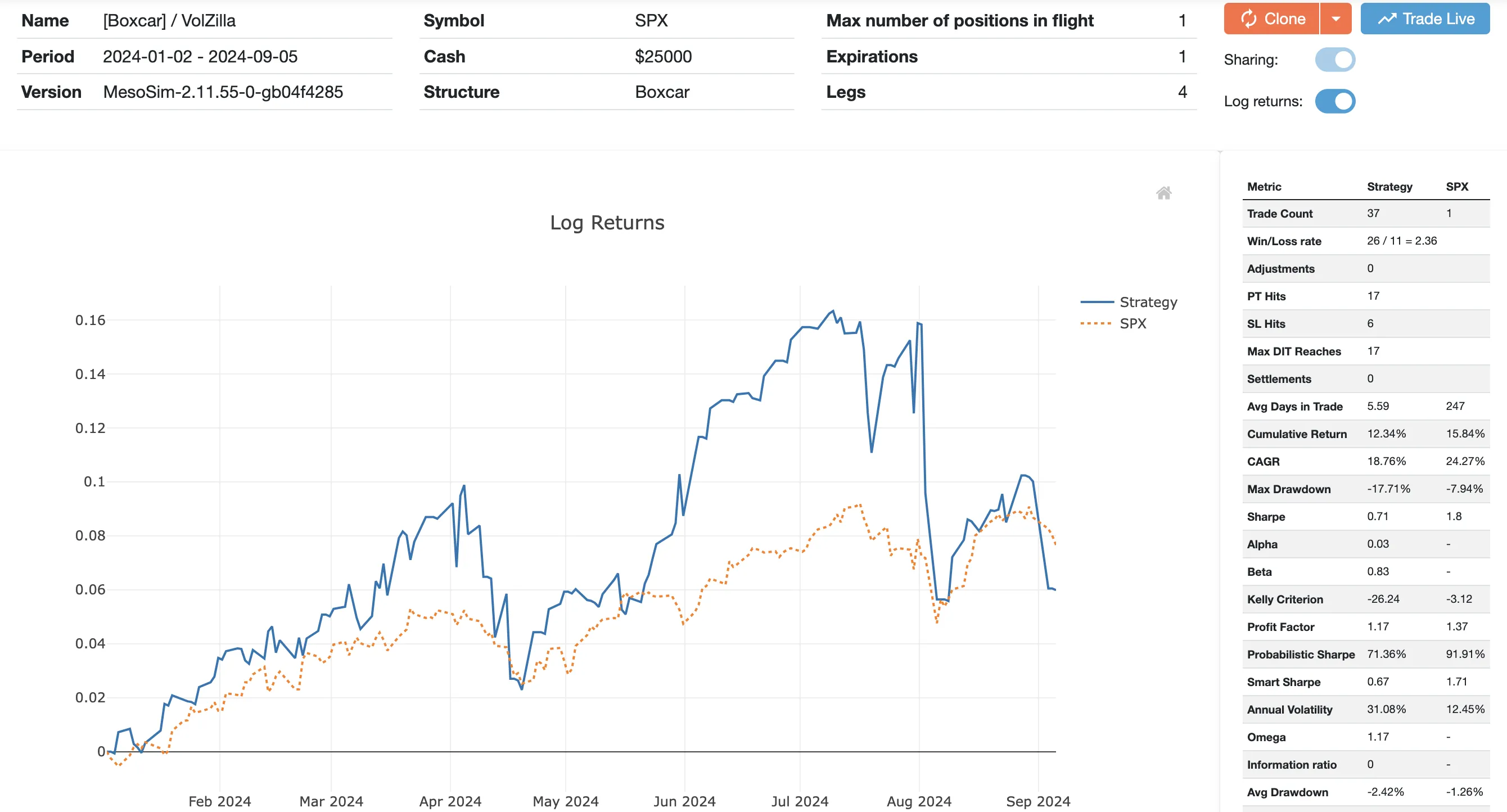

Boxcar trade

This trade was created by Dan Harvey from Aeromir and was the first trade we analyzed in depth on our blog on November 6, 2022.

It is an 8 DTE condor-like structure that benefits from the Weekend Effect. While this trade had some sideways performance in 2023, it performed well in 2024 and navigated through the VolZilla event without much difficulty. The drawdowns remain constrained, and its performance closely resembles the SPX's returns (beta = 0.83).

Associated backtest: https://mesosim.io/backtests/8ce8ec57-6754-441b-9cdf-789dafa36cf7

Thanks to Dan for creating this trade!

ShortPut 45DTE

We don’t have a dedicated blog post about this trade, but it has been available in our template library since its inception.

This trade is a naked short put initiated at 45 DTE. It is designed to illustrate the Volatility Risk Premium through option selling. It has no hedging component, and its margin requirements may vary depending on the account type and the brokerage’s policies.

Despite being a naked position, the trade did not incur devastating losses. Since the VolZilla event resulted in only a 10% drop, the trade recovered quickly once the SPX bounced back.

Associated backtest: https://mesosim.io/backtests/9d0b795d-491f-4669-ac75-e8c3468641d3

ShortPut 45DTE + Trailing Stop

We featured this trade in our blog on September 13, 2023.

This trade offers a slight variation on the short put strategy mentioned above: it uses a trailing stop mechanism to capture profits. During the VolZilla event, the trailing stop was triggered, resulting in a large realized loss. Although the trade has started to recover since then, it has not fully recovered from the losses.

This trade serves as a reminder of the risks associated with using stops, which is well illustrated by this picture (courtesy of Robot James from RobotWealth):

Associated backtest: https://mesosim.io/backtests/98830b85-9730-447b-b999-421089223f74

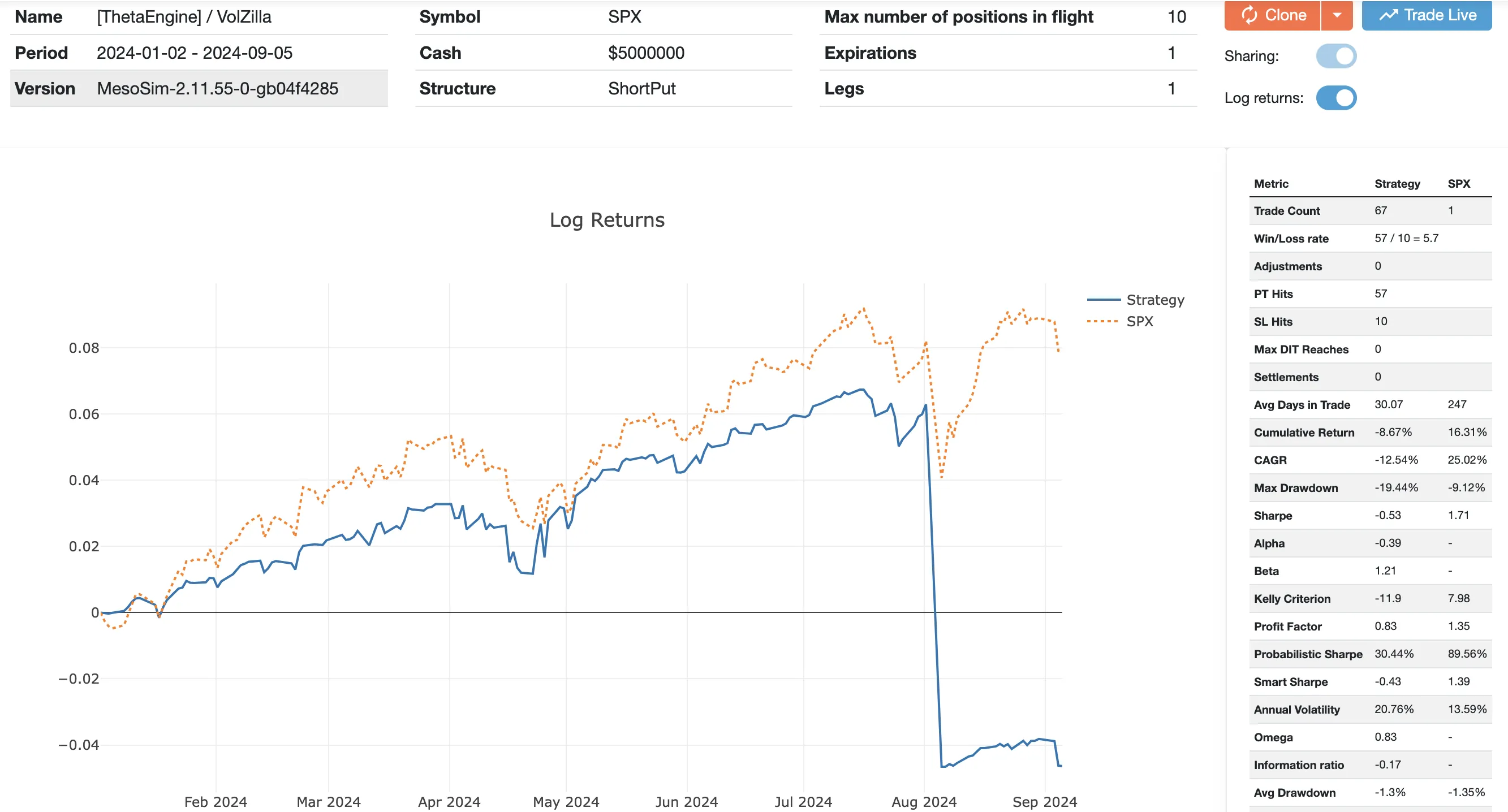

ThetaEngine

ThetaEngine is a Short Put strategy leveraging Credit Targeting, developed by David Sun. It was the first featured trade on our blog, published on October 2, 2022.

The losses encountered during VolZilla were realized by hitting the stop loss, similar to the trailing stop scenario mentioned above. Please note that David originally suggested a more conservative credit target in his trade; our variant targets 25%. With his allocation the losses would have been more moderate.

It is also important to highlight that David recommends using a hedging component (his "Bomb Shelter" or "Vibranium Shield"), which is not included in this trade plan.

Associated backtest: https://mesosim.io/backtests/e1bbbaf2-291c-4710-8bff-251b9e87a377

Thanks to David for developing and sharing this trade.

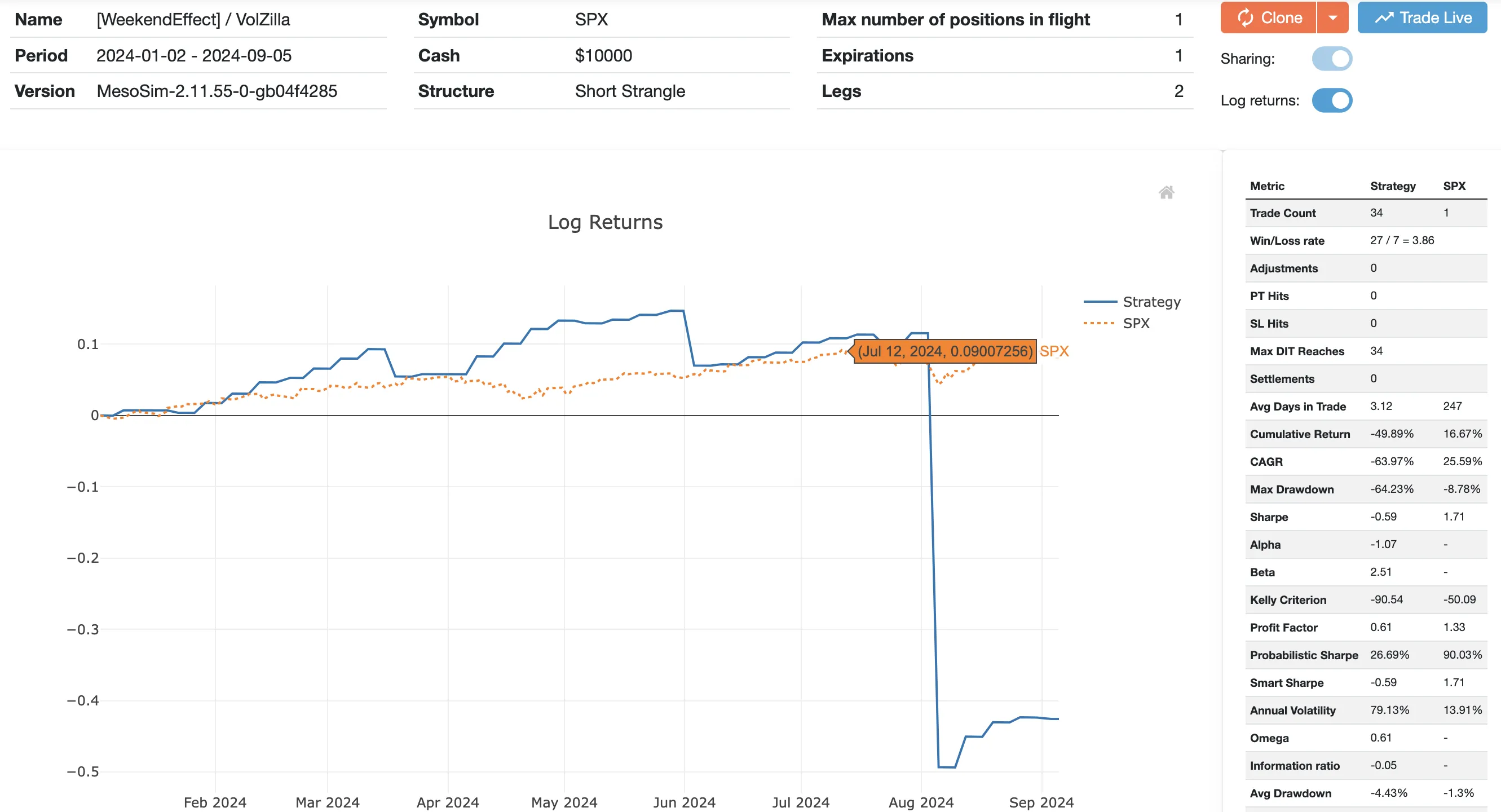

Weekend Effect

We implemented this trade based on Euan Sinclair’s Positional Options Trading book and featured it on our blog on September 19, 2023.

It is a 3 DTE short strangle, initiated 15 minutes before the market close on Friday and closed on Monday morning.

Like the majority of trades published on our blog and included in our templates, this strategy has no hedging component. We explicitly call this out in every post, and the Weekend Effect trade is no exception. Additionally, the margin requirement is highly dependent on the account setup and the portfolio content, so the sizing of the trade may vary.

This trade illustrates one of the worst possible scenarios: initiating the trade right before a significant market event. Over the weekend, the puts depreciated in value, resulting in a large loss by Monday.

Associated backtest: https://mesosim.io/backtests/b9284eed-f2c1-4374-a3b2-4bac6b3487ef

Thank you to Euan for sharing this trade.

If you are interested in options trading, Euan’s books should be high on your reading list.

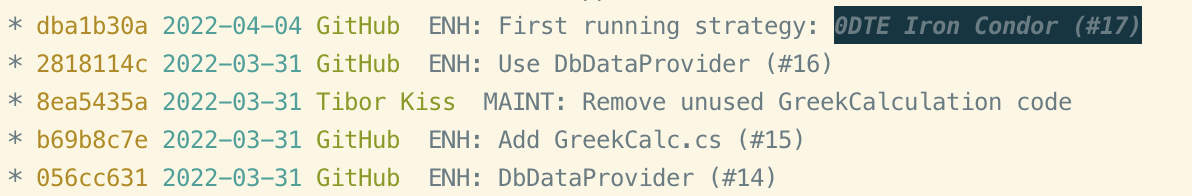

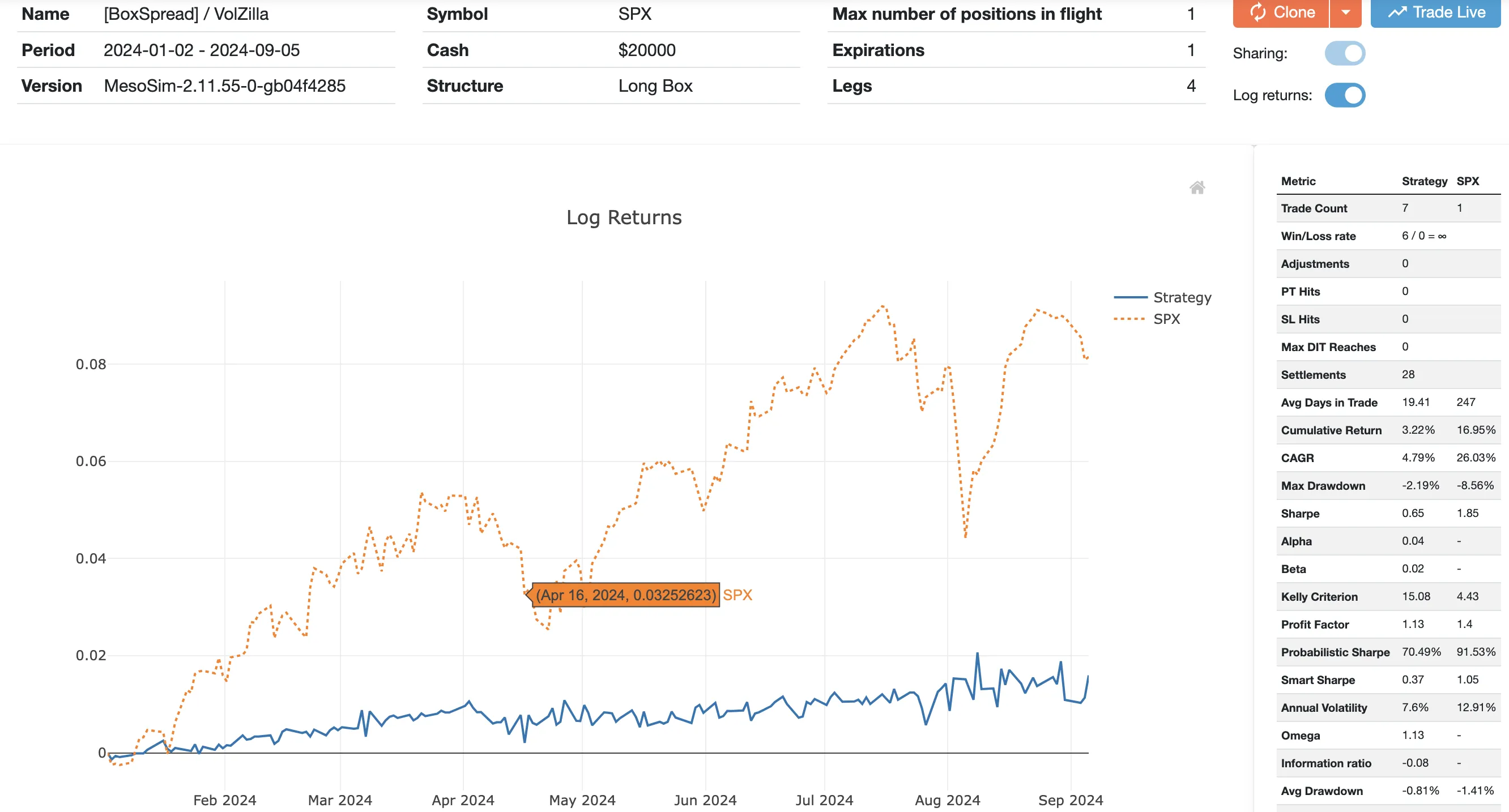

0DTE IronCondor

We didn’t cover this trade in a blog post so far, but it’s the very first full strategy we got it running in MesoSim, back on 4th of April, 2022:

The strategy is based on Tammy Chambless’s 0DTE strategy. Unfortunately, the video describing this strategy is not available anymore, but we’ll summarize it briefly here:

Every Monday, Wednesday, Friday we open a 0DTE Iron Condor structure 30 minutes after the open. Shorts are at 5 delta, the longs are 25 points away. Stop Loss is set to 3x the credit received on the put side. This strategy performed well in 2023. This strategy performed well in 2023.

Since this strategy doesn’t hold any assets overnight, its drawdown is coming from Friday (2nd of Aug, 2024). The StopLoss was activated, resulting in a sizable drawdown. Nice illustration of “Collecting pennies in front of Steamroller”.

Associated backtest: https://mesosim.io/backtests/398e4ea8-353d-4294-8112-7715268c293f

Thanks to Tammy for creating and sharing this trade!

NetZero

NetZero was developed by Andrew Falde and further refined by Mark Moseley. We published it back on March 7, 2023.It is a 60 DTE at-the-money (ATM) Broken Wing Butterfly on the put side with additional management rules. We have modified these rules slightly to make the structure truly delta-neutral. This variant is the one used in this test.2024 has not been a favorable year for NetZero: the strategy has been in continuous decline, with only 3 out of 42 trades being winners. The VolZilla event had little effect on this trade. Please note, that we turned off the LogReturn charting for the screenshot below as negative bankroll causes a less readable return graph.

Associated backtest: https://mesosim.io/backtests/03a9fcc1-4c2d-430c-8bc2-cf53848b4ee2

Thanks to Andrew and Mark for creating and sharing this trade.

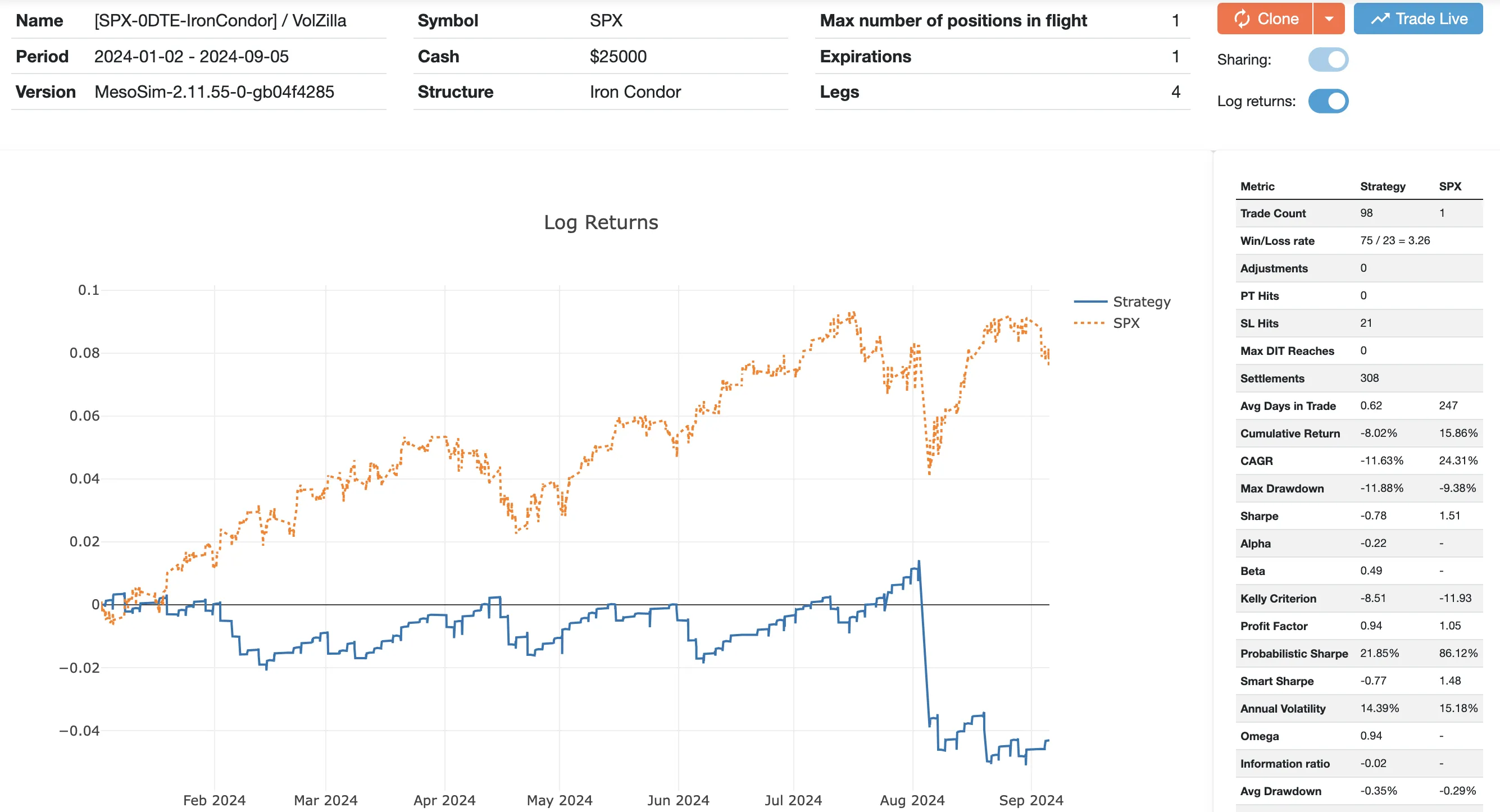

Boxcar-NG

This trade is our variant of the Boxcar strategy, published in November 2022.

We added entry filters based on IV Rank and opted for a delta-neutral trade initiation. While our modifications performed better in a sideways market (2023), they do not appear to be a good choice for strongly trending market regimes, such as in 2024.

In conclusion, after a period of sideways movement, we encountered a large loss, similar to the Boxcar’s drawdown during the event.

Associated backtest: https://mesosim.io/backtests/af9d786d-65b3-4b9e-926c-95bf05e4f3a5

We recommend considering the original Boxcar instead of this variant.

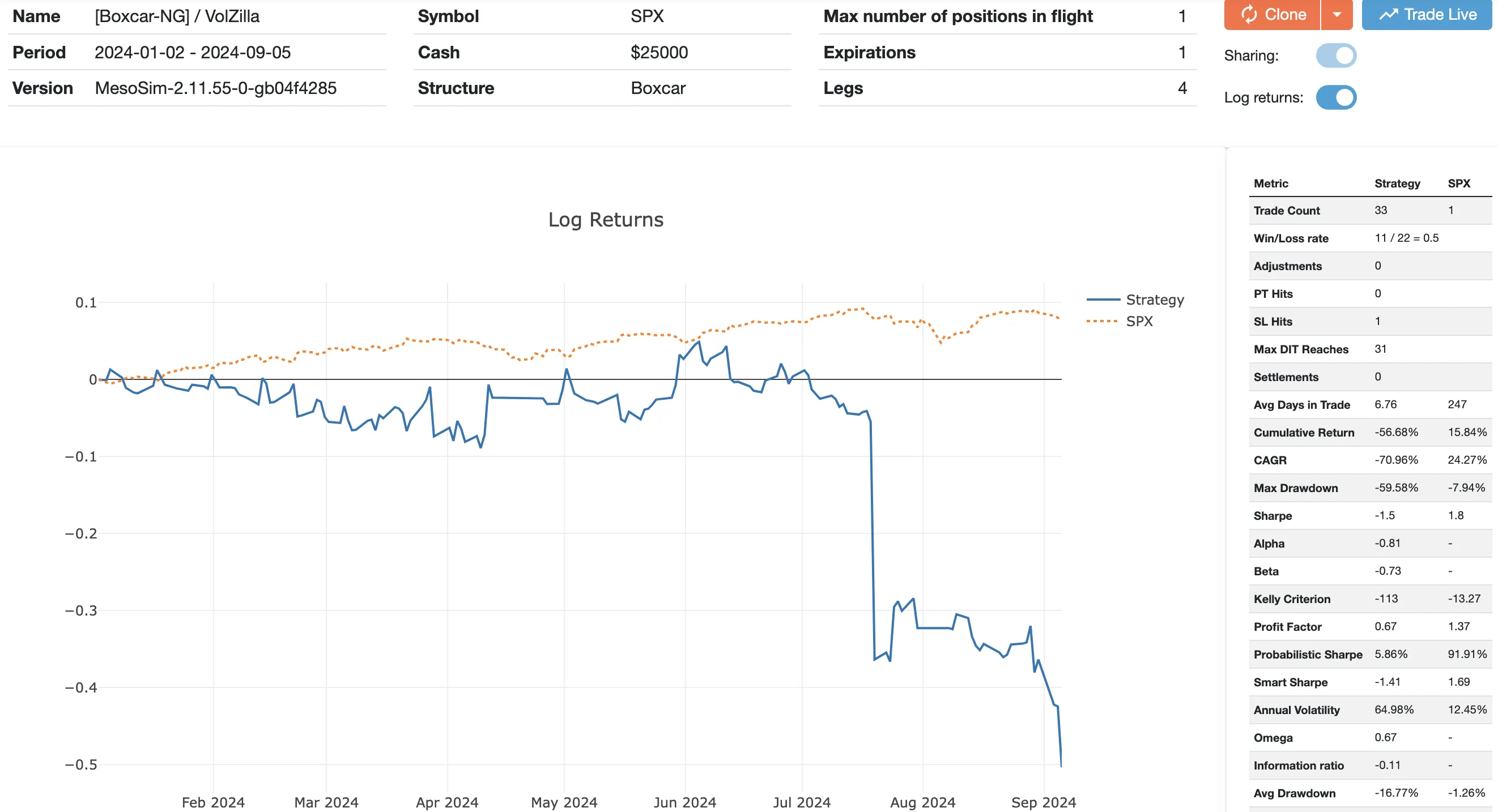

BoxSpread

This strategy comes last because it is a special one. Instead of leveraging the Directional movements or Volatility Risk Premium, it uses the option chain to extract the risk-free rate through synthetic long and short positions.

We shared this trade via our email newsletter on November 28, 2023:

"We're introducing a new trade in MesoSim: The Box Spread, a 4-legged trade that can be used to extract the Risk Free Rate from options. If you want to learn more, visit www.boxtrades.com."

As the trade's delta, gamma, and vega are all near zero, it should be unaffected by the VolZilla event.

And that is exactly what we observed in our backtest:

Associated backtest: https://mesosim.io/backtests/1717f96e-e387-48bd-b46d-006b8d3af59e

Conclusion

Two trades from our strategy library passed the VolZilla event with flying colors: the Relaxed SuperBull and the Volatility Hedged Theta Engine.

The remaining trades were all unhedged and created primarily for demonstrating theta harvesting, which is reflected in their performance during the VolZilla event.

It is imperative that traders use adequate hedging when selling options, especially when holding positions overnight or over the weekend.

As the tests show, markets are constantly changing. To be successful, one must employ the strategy that best fits the current market regime.