GLD Put-Write Strategy

Exploring alternative assets like GLD ETF options enhances portfolio diversification by tapping into distinct volatility profiles and correlation patterns, especially beneficial during volatile market environments.

In this post, we examine a simple, yet effective Put-Write strategy applied to GLD ETF Options, demonstrating how precious metals can serve as source of options income.

GLD for Portfolio Diversification

Gold has historically served as an inflation hedge, making GLD options particularly attractive during monetary uncertainty. During market stress, gold often exhibits negative equity correlation, providing "crisis alpha" when traditional assets decline. GLD's volatility profile, distinct from equity indices, offers unique opportunities for Volatility Risk Premium (VRP) harvesting.

Weight: Each GLD share represents approximately 1/10th of an ounce of gold. If you were assigned on 1 put contract, you'd own the equivalent of about 10 troy-ounces of gold (311 gramms).

Liquidity: GLD options often have better bid-ask spreads than many individual stocks, despite being a commodity ETF. This is because GLD is one of the most actively traded ETFs, with over $100 billion in assets.

Carry: Due to storage and insurance cost, GLD has a negative Carry. This carry cost is in GLD Options, too: Long Box Spreads create a negative yield on GLD, while delivering the Zero Coupon Rate in SPX and RUT.

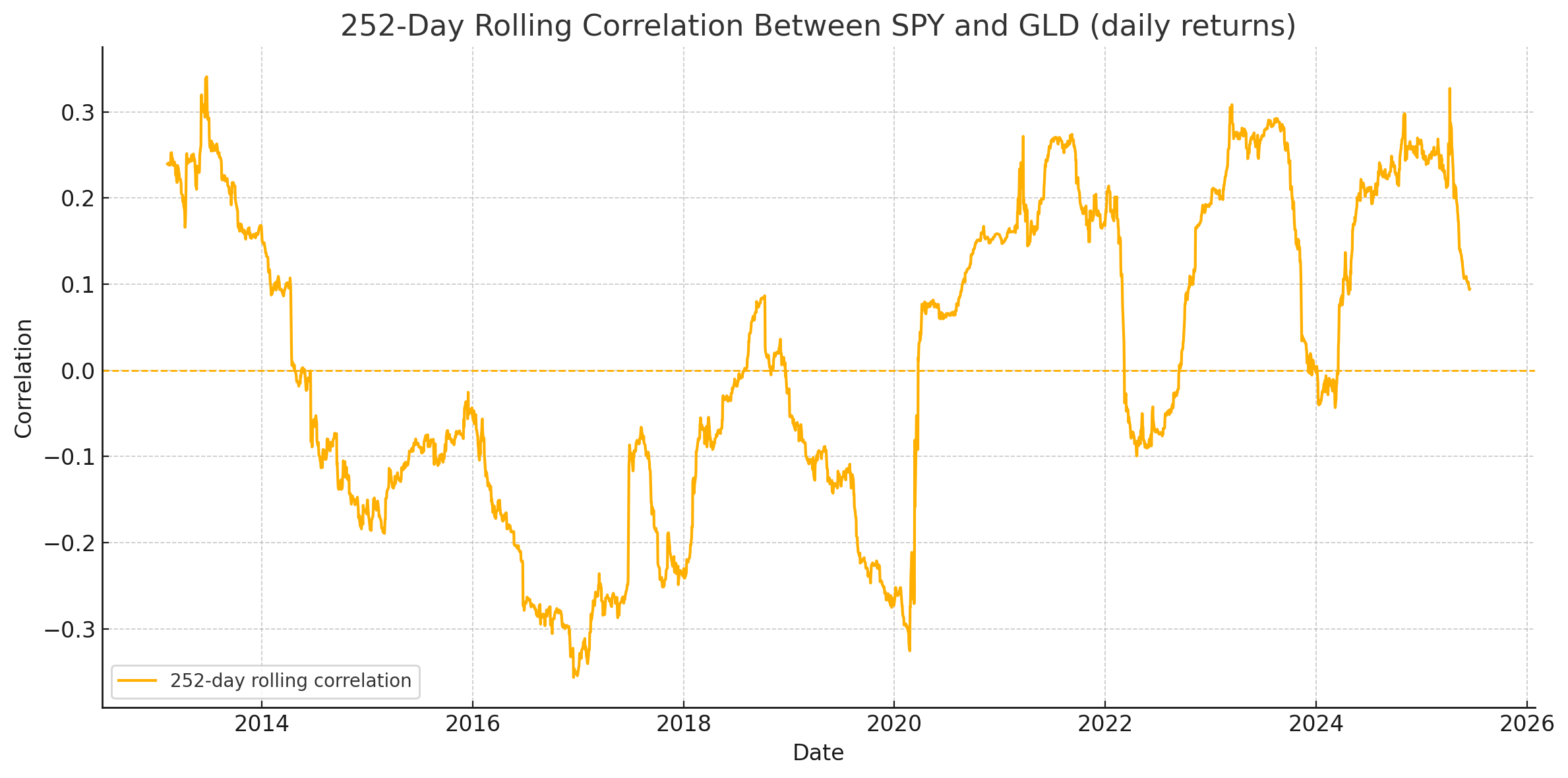

Correlation Analysis

A significant appeal of GLD is its low correlation with equity markets. Over the past decade, GLD's rolling correlation with the S&P 500 ranged between -0.3 and 0.3 (252-day window).

The Strategy: Pure Put-Write

The GLD Put-Write strategy utilizes straightforward cash-secured puts, effectively capturing the volatility risk premium.

Based on substantial activity around the 30 DTE mark indicated by the Volatility Surface and high Open Interest, the strategy consistently targets these expirations for optimal liquidity and performance.

Our trials confirm that selling puts at 25 delta strikes with 30 days to expiration yields favorable risk-adjusted returns.

- Underlying: GLD (SPDR Gold Trust ETF)

- Structure: Short Put (Put-Write)

- DTE: 30 days to expiration

- Delta Target: 25 delta (out-of-the-money)

- Entry Frequency: Daily, up to 10 positions in flight

- Exit: Max 30 days in trade with early exit simulation

Strategy Definition Analysis

Let's break down the MesoSim Strategy Definition to understand each component:

Top-Level Configuration

{

"StrategyName": "[GLD-Short-Put]",

"Backtest": {

"Name": "GLD-PutWrite",

"Start": "2020-01-01T00:00:00",

"End": "2025-06-18T23:59:59",

"Cash": "100000.0000"

},

"Symbol": "GLD"

}

The backtest spans 5 years (2020-2024) with $10,000 initial capital, providing sufficient data to evaluate performance across different market regimes including the COVID-19 pandemic, inflation surge, and subsequent normalization.

Structure Definition

"Structure": {

"Name": "Short Put",

"Expirations": [

{

"Name": "exp1",

"DTE": "30",

"Min": null,

"Max": null,

"Roots": null

}

],

"Legs": [

{

"Name": "short_put",

"Qty": "-1",

"OptionType": "Put",

"ExpirationName": "exp1",

"StrikeSelector": {

"Delta": "25"

}

}

]

}

The structure defines a single-leg strategy: selling one put option contract with 30 DTE targeting 25 delta. The 25-delta selection provides a balance between premium income and assignment risk, positioning the strike out-of-the-money with approximately 25% probability of finishing in-the-money.

Entry and Exit Rules

Entry Schedule:

"Entry": {

"Schedule": {

"BeforeMarketCloseMinutes": "30",

"Every": "day"

},

"ReentryDays": "0",

"Concurrency": {

"MaxPositionsInFlight": "10",

"EntryShiftDays": "1"

}

}

The strategy enters positions daily, 30 minutes before market close, allowing 10 parallel position using daily entries (campaign trading).

Exit Conditions:

"Exit": {

"Schedule": {

"BeforeMarketCloseMinutes": "30",

"Every": "day"

},

"MaxDaysInTrade": "30",

"Conditions": [

"leg_short_put_dte < 5 and underlying_price < leg_short_put_strike * 0.98 and random(0, 1) < 0.05 -- exit with 5% probability when option becomes ITM"

]

}

Maximum 30-day holding period with a simulated early exit probability (5%) when options move in-the-money by 2%.

Early Exit Simulation

Since random() is used in the Exit Condition the job will create slightly different results each time is run due to the randomness.

Execution Settings

"Settings": {

"Sim": {

"FillModel": "AtMidPrice",

"SlippageAmt": 0,

"Commission": {

"CommissionModel": "FixedFee",

"OptionFee": 1.5

},

...

},

...

}

The execution assumes mid-price fills with $1.50 commission per contract.

Performance Analysis

MesoSim Run: Access it here

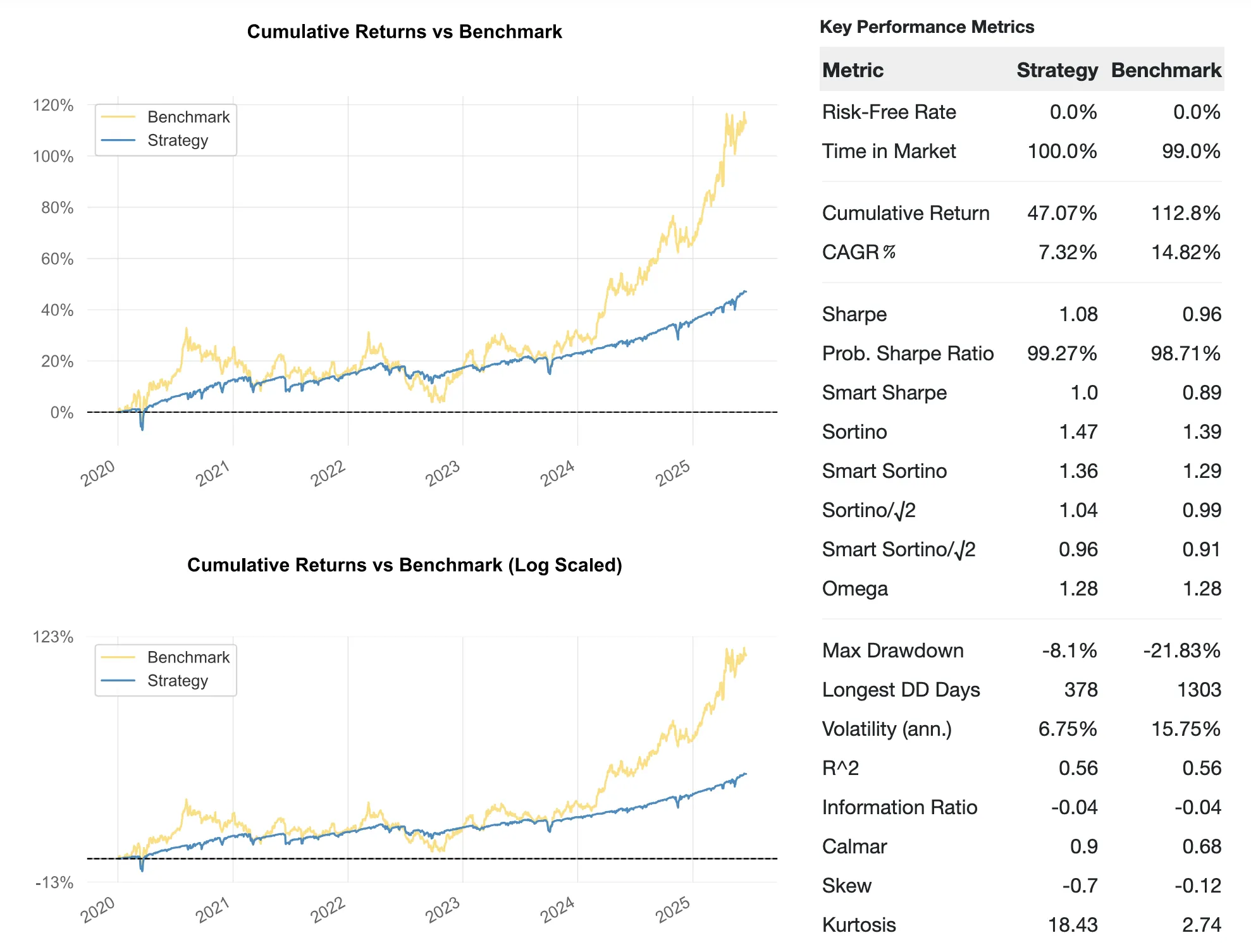

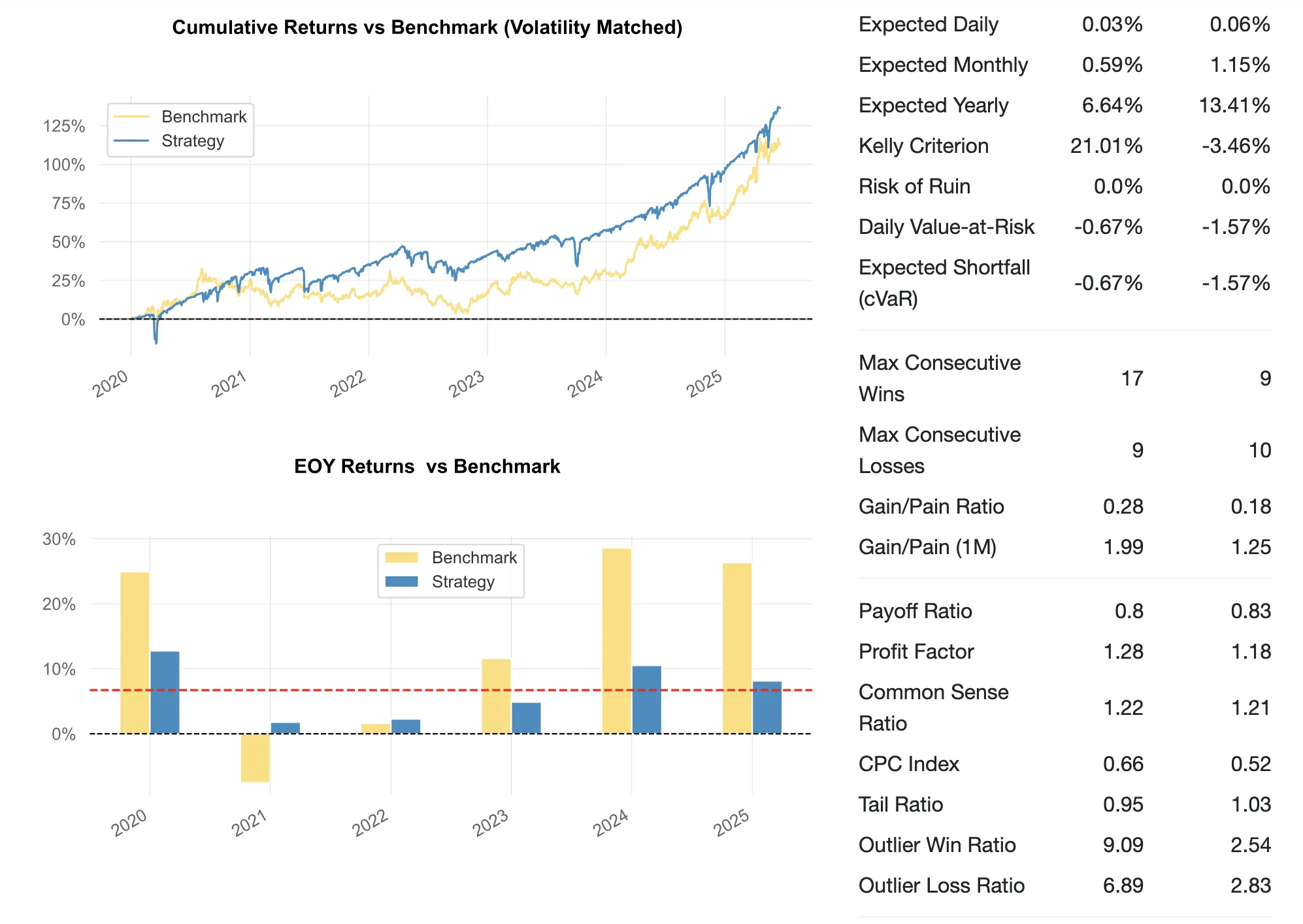

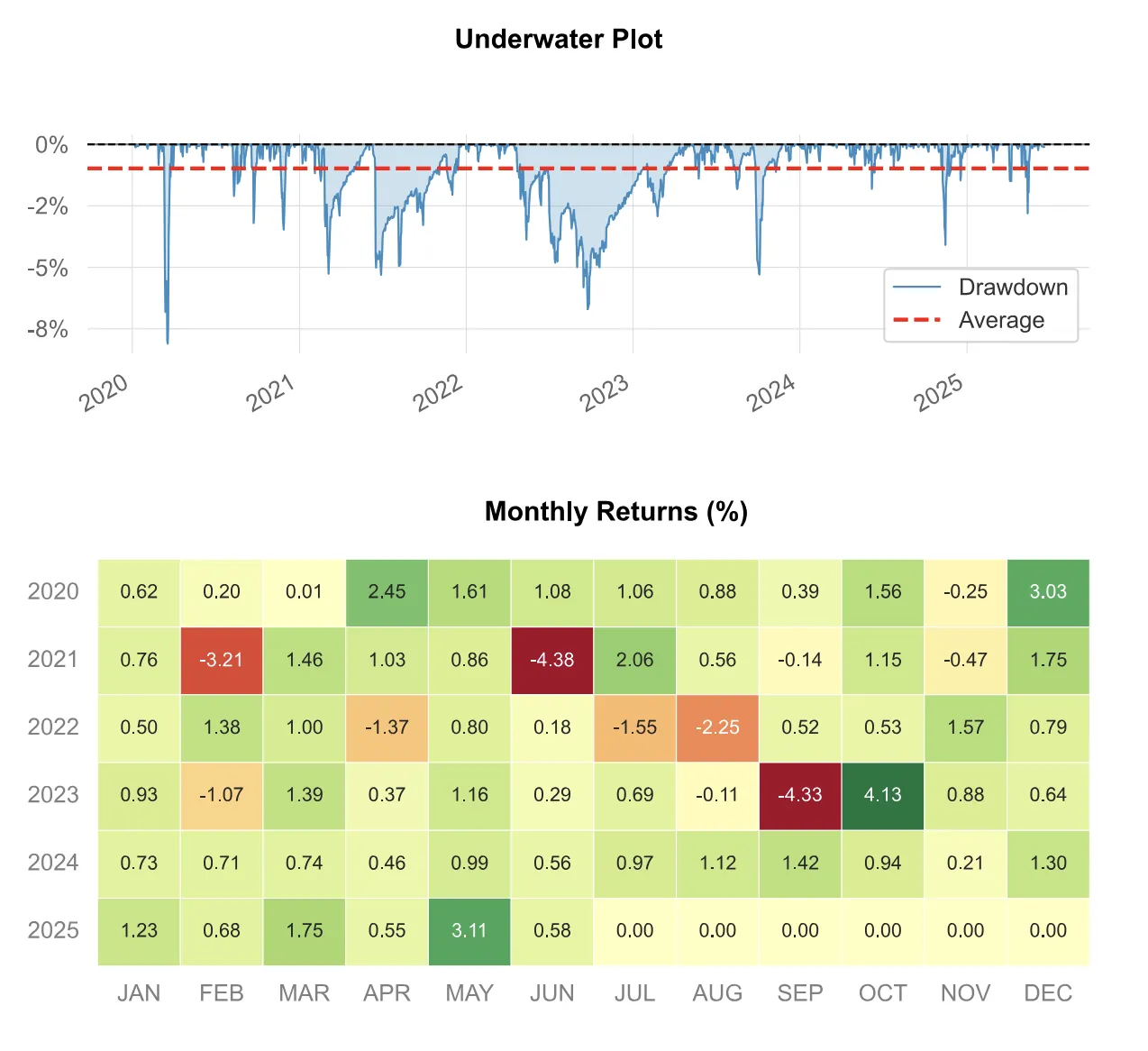

The backtest results demonstrate solid risk-adjusted returns:

| Metric | Value |

|---|---|

| Period | 2020-01-02 - 2025-06-18 |

| Sharpe Ratio | 1.08 |

| CAGR | 7.32% |

| Maximum Drawdown | -8.1% |

These results confirm consistent returns with moderate risk.

Since the Strategy Definition uses random() in the Exit Condition, the results will vary slightly in each run.

Future Enhancements

Hedging

- Delta Hedging:

Explore underlying hedging strategies for enhanced risk management - Volatility Hedging:

Opportunistic hedges can be added, similar to the Volatility Hedged Theta Engine strategy - IV Rank Filters:

Enter trades selectively during elevated implied volatility. See the Boxcar NG Trade for reference - Profit Targeting & Volatility-based Exits:

Optimize exits based on profit targets or volatility conditions. - Economic Calendar Filters:

Avoid entries around major monetary policy announcements. Timing such events are demonstrated in the QuantPedia Composite Seasonality Index post

Risk Considerations

- This strategy involves assignment risk - be prepared to purchase GLD shares at the strike price

- Gold prices can be volatile and influenced by geopolitical events, monetary policy, and currency fluctuations

- Consider position sizing carefully relative to overall portfolio allocation

- As with every options strategy, hedging is paramount. Explore hedges before implementing this strategy in live trading

Conclusion

For traders seeking to expand beyond SPX-focused strategies, GLD offers an accessible entry point into precious metals options trading. With a Sharpe ratio of 1.07 and CAGR of 8.7%, this simple approach provides attractive risk-adjusted returns while offering portfolio diversification benefits.

Explore this strategy further by Cloning the MesoSim Run.

Associated MesoSim Template: [GLD-Short-Put]

This article was originally written for MesoSim v2. The examples and terminology have been updated to match the MesoSim v3 Strategy Definition format. For details, see the MesoSim v3.0 release announcement and the v2→v3 migration guide. The performance metrics, described behavior, and referenced run results reflect the original v2 behavior. If you rerun the referenced strategies on MesoSim v3, results may differ slightly due to behavioral changes in the simulator.