MesoLive SDK: a safer, smarter Execution Layer

Trading options can be an effective way to generate income and grow a portfolio, but results depend on process quality: disciplined research, repeatable execution, and risk controls that hold up in live markets.

Historically, MesoLive operated with a "human in the loop". With the MesoLive SDK, our customers can automate execution while keeping the controls and oversight their operation requires.

The SDK is a toolkit for building a firm-specific Execution Management System (EMS) on top of the FundPro ecosystem - enabling automation without compromising governance, approvals, or risk policy.

This release connects the full Trade Factory lifecycle:

Discover → Validate → Forward-test → Execute → Monitor → Re-optimize

While the focus here is the MesoLive SDK, which is part of the FundPro offering, we also delivered multiple enhancements for Retail customers. You’ll find the full list below.

Motivation and background

Execution is more than sending orders: it’s about managing risk, handling exceptions, and integrating with your existing workflows.

That matters even more in options trading, where multi-leg strategies often face wider spreads and combo orders might get rejected due to illiquidity (one-sided market) or margin constraints.

Many tools aim to ship a "trading bot", which works on the happy path, but often lacks the flexibility and controls that real-world trading operations require.

We take a different approach:

provide a reliable execution core, then expose the operations needed to build your EMS - with your controls

to create a safer, smarter Execution Layer for Options Trading.

MesoLive SDK

To address the above challenges, we expose MesoLive functionality via an API and provide a Software Development Kit (SDK) to make it easy to integrate. MesoLive builds on the MesoSim Strategy Definition, so execution logic is fully aligned with strategy's structure and rules.

With the MesoLive SDK, you can:

- Execute exactly the Strategy Definition specifies (structure, sizing, adjustments, exits)

- Enforce guardrails where capital is deployed (limits, approvals, monitoring)

- Integrate with existing workflows and infrastructure rather than reshaping your process around a black box "trading bot"

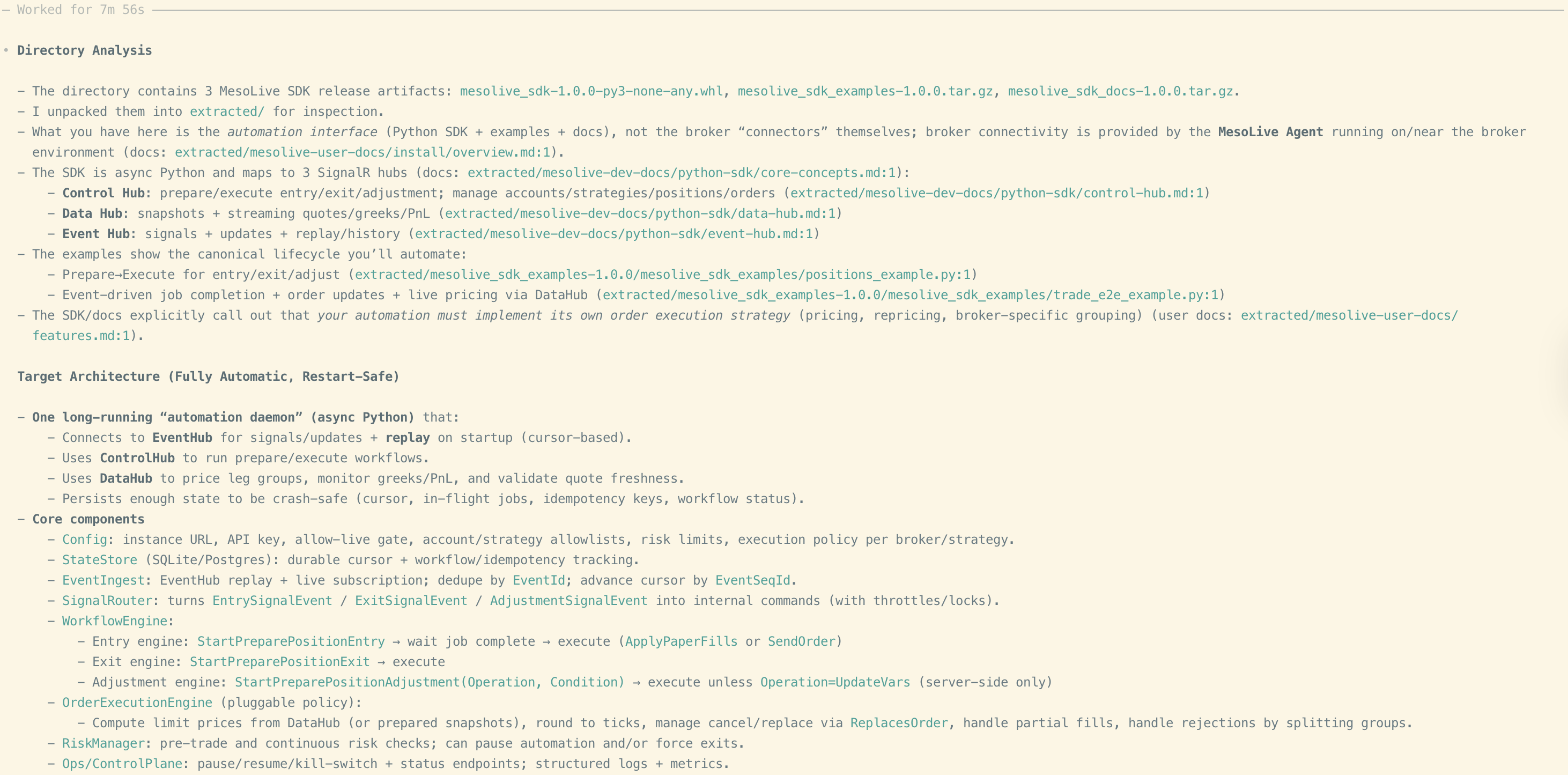

AI-assisted onboarding

We include comprehensive documentation with best practices and examples in the SDK so an AI Agent can build efficiently on top of these services.

With these resources, a coding agent can generate a starter EMS harness in a single pass: connectors, order submission flow, event handlers. You can then plug in your own control logic (limits, approvals, monitoring), and rollout before any live deployment.

Note: The SDK is fully usable without AI, the agents just accelerate the development cycle.

Build your own EMS

An Execution Management System (EMS) is the layer that translates signals into orders and governs:

- Risk checks and limits

- Approvals and escalation paths

- Retries, rate limits, and incident handling

- Audit trails and monitoring

The MesoLive SDK provides the foundation to implement this cleanly - without rebuilding execution primitives from scratch.

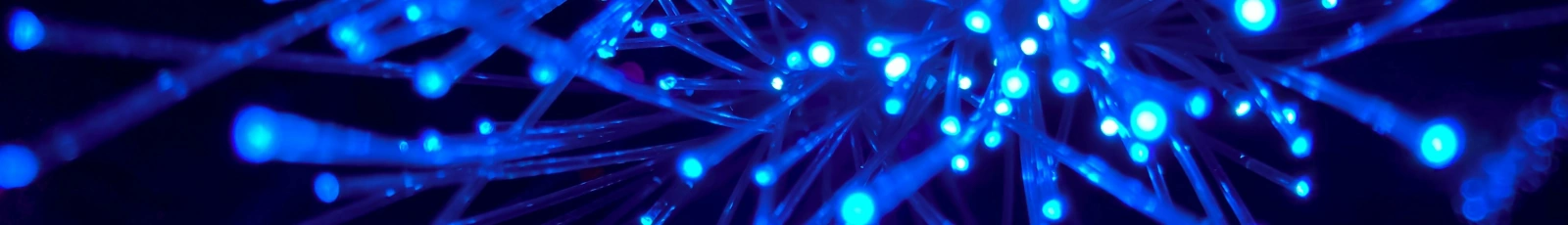

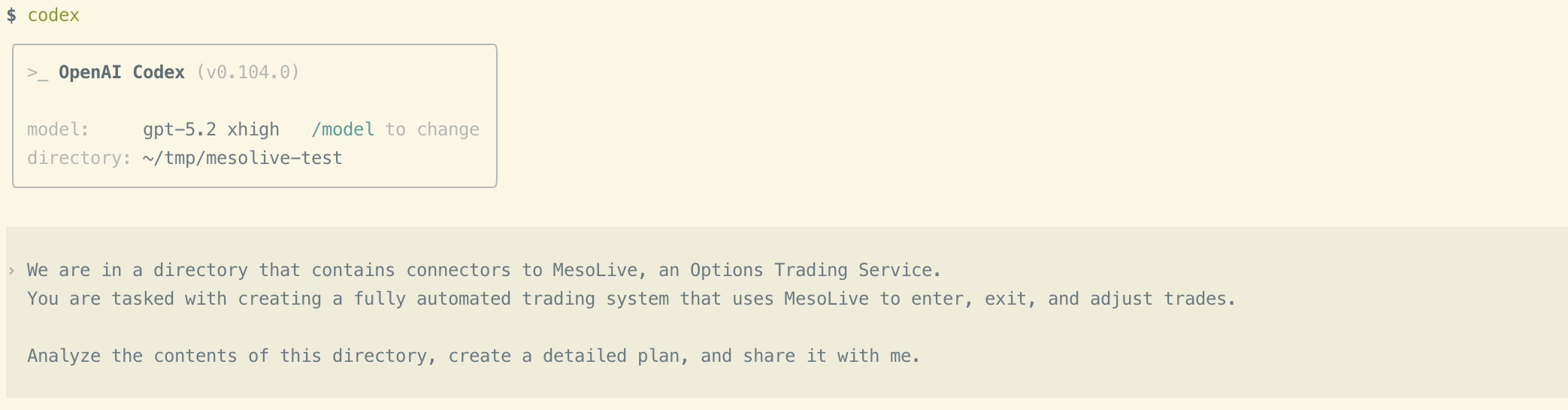

A typical integration looks like this:

- Generate a baseline execution harness using a coding agent (e.g., OpenAI Code or Claude Code) and the SDK.

- Replace defaults with your firm-specific constructs:

- Risk checks: exposure bounds, max loss, limits

- Approval routing: review queues, escalation, overrides

- Scheduling and throttling: intraday cadence, order rate limits

- Event handling: fills, rejects, partial fills

- Roll out in stages:

- Paper trading

- Limited live deployment

- Full production

Safety-first in execution

Automation only matters if it’s safe under live conditions.

We added multi-provider pricing so your EMS (or a human operator) can validate fresh, active prices before submitting orders.

Supported data providers:

- IBKR

- Tastytrade

- Tradier

We suggest implementing Quorum-style validation:

- If two out of three providers agree, the system can proceed with enter/exit/adjust operations with higher confidence.

- If quorum fails, your EMS can be configured to pause, require approval, re-quote, or route to an alternative workflow.

Currently, Tradier is supported as a data provider in FundPro setup only. As soon as we have a full implementation we will roll out Tradier to Retail customers as well.

The FundPro Edge

Research

MesoSim enables research and backtesting of complex multi-leg options strategies. FundPro extends this into an automated Trade Factory - a pipeline that can systematically search, validate, and refresh strategies under real constraints.

FundPro can:

- Discover and validate new trade candidates using:

- Genetic Algorithms

- Grid Search

- Monte Carlo validation

- Optimize existing strategies using:

- Machine-learning models designed for trading

- Portfolio optimization techniques such as Mean Variance Optimization and Hierarchical Risk Parity

The deliverable is a Strategy Definition: the canonical, versioned description of the structure and its lifecycle rules—ready for trading and, now, high-integrity automation.

Validate

Backtests are necessary, but forward tests are where execution and monitoring get real.

MesoLive’s paper trading enables forward-testing of multiple variants - with or without optimization - to see how they perform in live conditions.

This helps you validate:

- Live quote behavior: spreads, pnl variance

- Margin requirements as part of the portfolio

- Monitoring, alerting, and approval workflows

Execute

MesoLive is designed to execute what was defined in the MesoSim Strategy Definition. With FundPro + MesoLive SDK, firms can cover most real-world workflows:

- Strategy lifecycle management

- Build, incubate, and track strategies before going live

- Controlled promotion from paper to production

- Audit and observability

- Full audit trail of signals, Greeks, and P&L at the position, strategy, underlying, and account levels

- Integrations

- Connect external brokerages and services not directly supported by the native system

- Standardize execution across venues and accounts

- Risk modeling

- Risk analytics aligned with high-quality provider Greeks and Implied Volatilities

- Reporting

- Custom dashboards and UIs for execution, monitoring, and reporting

Retail improvements

Many of the upgrades that make the MesoLive SDK production-ready also benefit Retail MesoLive customers, including:

- Marker legs are now fully supported

- Support up to two MesoLive paper accounts in advanced plan (e.g., Schwab integration + forward testing)

- Real-time margin calculation when margin is enabled in the strategy

- Quantity multipliers

- ConditionalAdjustments with UpdateVars execute automatically

- Updated documentation site

Next steps

We’ve begun rolling out the MesoLive SDK to FundPro customers. In the coming weeks, we’ll onboard all existing customers to the new system and provide support throughout the transition.

Tradier execution is currently in progress. Full execution support is planned for 2026 Q2 for both Retail and FundPro plans.

You can learn more about the FundPro offering here: https://deltaray.io/fundpro